private placement life insurance investopedia

A warrant is a derivative that confers the right but not the obligation to buy or sell a security normally an equity at a certain price before expiration. Long Term Private placements provide longer maturities than typical bank financing at a fixed-interest rate.

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Types Of Life Insurance Policies

An underwriter is any entity that evaluates and assumes another entitys risk for a fee such as a commission premium spread or interest.

. Offering securities to the public or. The advantages and disadvantages of hedge funds are defined and discussed here. The distribution waterfall is the order in which a private equity fund makes distributions to limited and general partners.

Private equity at its most basic is equity ie. Accredited investors can invest money in the profitable world of private equity private placements venture capital hedge funds and equity crowdfunding. A placement agent is an intermediary who raises capital for investment funds.

The management of a company issuing securities or doing an initial public offering IPO travels around the. Private placements present the following advantages. Leverage is the investment strategy of using borrowed money.

A business would have more time to pay back the. Private equity is a source of investment. Specifically the use of various financial instruments or borrowed capital to increase the potential return of an investment.

Private Equity. A private investment in public equity PIPE is a private investment firms a mutual funds or another qualified investors purchase of stock in a. Underwriters operate in many aspects of the.

This document includes items such. A road show is a presentation by an issuer of securities to potential buyers. A security is a fungible negotiable financial instrument that holds some type of monetary value.

It is a hierarchy delineating the order in which. A private company can raise capital by selling shares publicly to institutional investors and retail investors through a new stock issuance called an initial public offering IPO. Private Investment in Public Equity - PIPE.

A mutual fund is an investing vehicle that owns a portfolio of assets and sells shares to investors. Shares representing ownership in an entity that is not publicly listed or traded. Initial Public Offering IPO vs.

The price at which the. The four Ps are the categories that are involved in the marketing of a good or service and they include product price place and promotion. Financial professionals establish mutual funds manage the assets held by the fund and attempt.

Investment banks underwrite new debt and equity. Hedge fund investing has been common for both institutions and high net worth individuals in the past couple of decades. Private companies that seek to raise capital through issuing securities have two options.

Investment banking is a specific division of banking related to the creation of capital for other companies governments and other entities. A placement is the sale of securities to a small number of private investors that is exempt from registration with the Securities and Exchange Commission under Regulation D as are. Shariah-compliant funds are considered to be a type of socially.

An offering memorandum is a legal document that states the objectives risks and terms of an investment involved with a private placement. Shariah-compliant funds are investment funds governed by the requirements of Shariah law and the principles of the Muslim religion. Often referred to as the marketing mix the.

This is ideal for when a business is presented with a growth opportunity where they wouldnt see the return on their investment right away. A placement agent can range in size from a one-person independent firm to a large division of a. A primary market issues new securities on an exchange for companies governments and other groups to obtain financing through debt-based or equity -based securities.

Escrow accounts make life a lot easier for the majority of homeowners that want to add predictability to their monthly expenses rather than getting whacked twice a year with big insurance and. For example if there were 1 million shares of a companys stock outstanding prior to a private placement offering of 100000 shares then the private placement would result in existing. A private placement is a capital raising event that involves the sale of securities to a relatively small number of select investors.

It represents an ownership position in a publicly-traded corporation via stock a. A subscription agreement is an application by an investor to join a limited partnership and it is also used to sell stock shares in a private company. Investors involved in private placements.

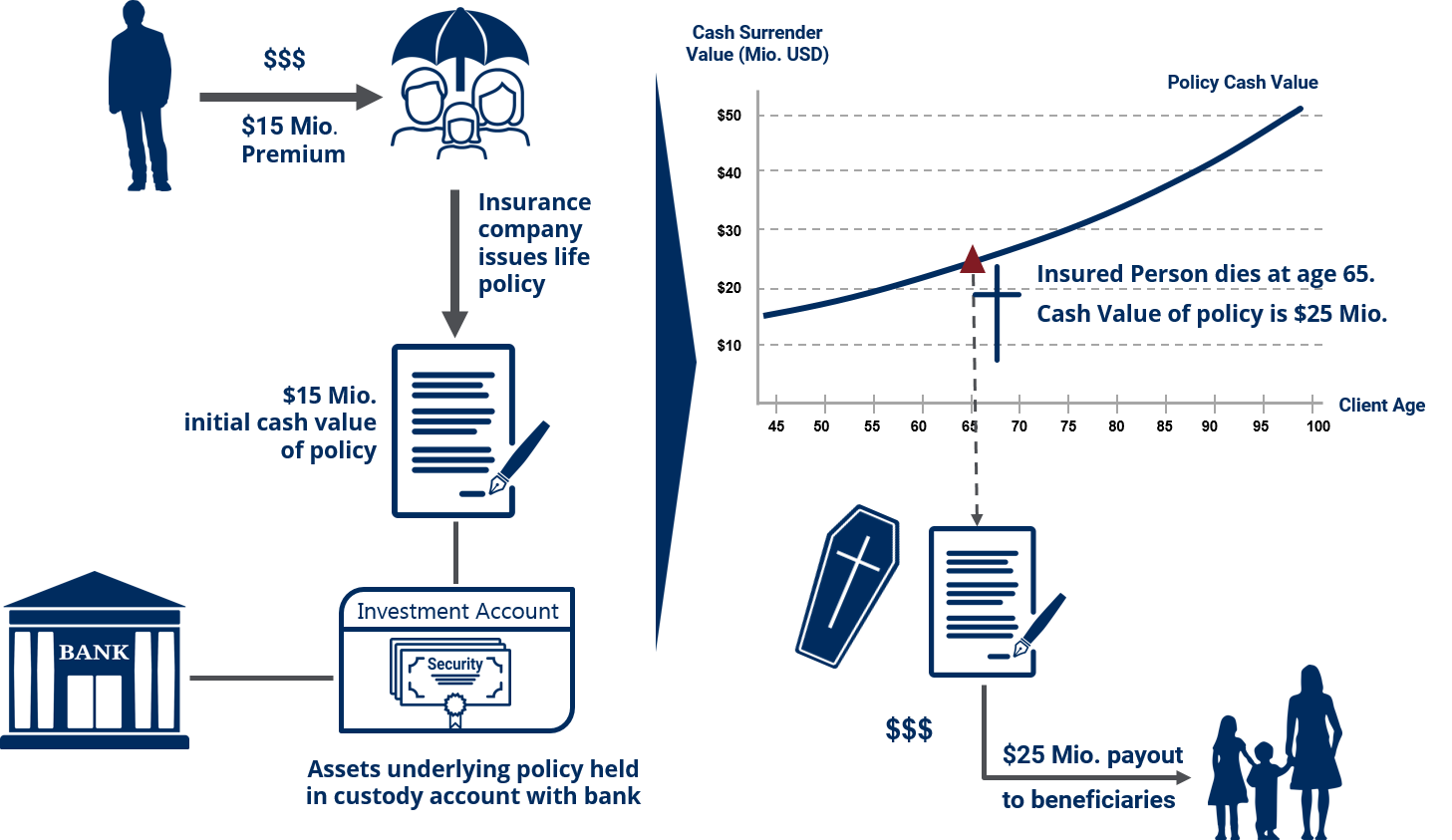

What Is Private Placement Life Insurance Ppli And Who Is It For

The Ultimate Guide To Private Placement Life Insurance Worthune

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

Where Does The Big Dough Go It Goes Into Private Placement Life Insurance Heritage Retirement

Benefits Of Private Placement Life Insurance

:max_bytes(150000):strip_icc()/GettyImages-475702616-3d8d1ec251704afbbd1a3f9580d63bcb.jpg)

Types Of Life Insurance Policies

:max_bytes(150000):strip_icc()/INV-Exp-180-ETFs-Thumbnail-773444928b0842de83ddc2fc9449bfaf.png)

Investopedia Sharper Insight Better Investing

Solar Revenue Put Blog Kwh Analytics

Private Placement Life Insurance Explained Wealth Management

How Does Private Placement Life Insurance Work Valuepenguin

:max_bytes(150000):strip_icc()/insurance-9d68dd8aa5854570a057a2d759555438.jpg)

Types Of Life Insurance Policies

What You Need To Know About Private Placement Life Insurance Premier Risk Llc

/dotdash-what-are-major-differences-between-investment-banking-and-private-equity-Final-36b2c17dd9c447278b790d76f7c66b31.jpg)

Investment Banking Vs Private Equity

Private Placement Life Insurance Wikipedia

Life Insurance Solutions Envisage Gmbh

Private Placement Life Insurance Ppli Wrapper Strategy For Direct Investment Tax Efficiency Youtube

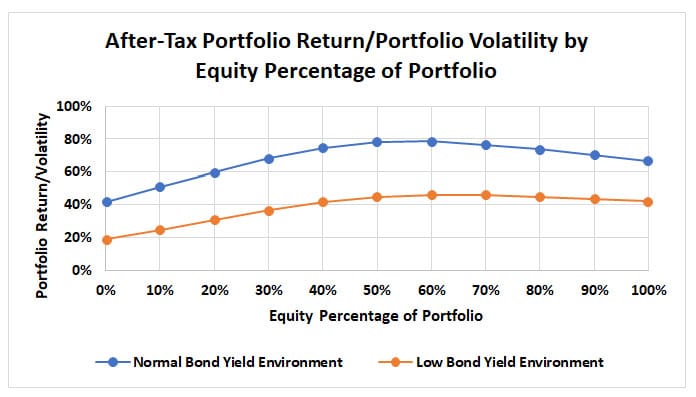

Creating Tax Efficient Investment And Estate Strategies For Uhnw Clients Through Private Placement Life Insurance Ppli In A Rising Interest Rate And High Tax Environment Colva Actuarial Services

/life_insurance-5bfc371046e0fb0083c33fed.jpg)